REAL ESTATE NEWS

NASHVILLE AREA HAPPENINGS

APRIL 2024

Rising Mortgage Rates Complicate Spring Outlook

The spring housing market is off to a sluggish start, with home sales falling in March. A resurgence in mortgage rates and inflation could be softening sales at the start of what is traditionally real estate’s busiest season. But despite the headwinds, sellers continue to see home prices grow, buyers’ appetite for housing remains high and bidding wars are still occurring. On top of that, a growing job market may offer some rosier prospects for more sales.

Existing-home sales dropped 4.3% in March compared to the previous month and are nearly 4% lower than a year ago. While more listings came on the market last month, the increased competition among sellers didn’t appear to hurt home prices. The median existing-home sales price increased 4.8% —the highest price ever recorded for March.

Meanwhile, builders pressed the brakes on new-home construction, sensing buyer hesitancy from rising mortgage rates. Builders also reported facing higher construction costs and tighter lending conditions last month. Permits for single-family housing starts dropped to a five-month low, indicating a slowdown in future construction as well.

Strong consumer spending and the recent resurgence in employment growth have helped keep the economy afloat despite higher interest rates and concerns over stubborn inflation. Yet they are both factors causing delay in the anticipated drop in interest rates. Until as recently as last month, markets had been anticipating up to three rate cuts this year, with the first in June. However, a string of banks have since pushed back their timelines, with Bank of America and Deutsche Bank both saying last week that they now expect just one rate cut in December.

With the historically low rates of the pandemic era now firmly behind us, some households appear to be moving past the hurdle of last year’s sharp jump in rates, an adjustment that could help further thaw the housing market. Fannie Mae predicts a gradual increase in sales transactions and home listings this year.

The national average 30-year fixed-rate mortgage now averages 7.49% though it heavily depends on a borrowers individual situation and factors such as their credit score and loan to value as to their exact quoted rate.

Latest Housing Data

- Housing inventories are rising: Total housing inventory was up nearly 5% compared to February and up 14.4% from a year ago.

- Home prices climb: The median existing-home price for all housing types was up 4.8% compared to a year earlier. All four major regions of the U.S. posted price gains last month, led by the Northeast and Midwest.

- Days on the market up slightly from a year ago: Properties typically remained on the market for 33 days. That is a quicker pace than the 38 days recorded in February but is up from 29 days a year ago.

- First-time buyers are increasing: The share of sales to first-time home buyers grew to 32%, up from 26% in February and 28% from a year earlier.

- All-cash sales still remain high: All-cash sales comprised 28% of transactions, down from 33% in February but up from 27% a year earlier. Individual investors and second-home buyers tend to make up the biggest bulk of all-cash sales.

The South: Sales fell 5.9% compared to February, settling in at an annual rate of 1.9 million. Sales are 5% lower than a year earlier but the median price is up 3.4% from last year.

Pent Up Demand - The Next Problem ??

It seems quite a while since the housing market has been anything close to normal and we were just navigating the usual, seasonal cycles. COVID in February 2020 lead to social isolation and sellers fear of strangers entering their homes. Meanwhile buyers found fault with the homes they were cooped up in and wanted change. Historically low interest rates facilitated a massive wave of buyer demand and relocation which saw multiple offers and bidding wars never seen before, pushing house prices often hundreds of thousands above asking. The Ukraine War in March 2022 saw the start of confidence wavering as mortgage rates started to rocket up.

As buyers and sellers have sat on the sidelines waiting for interest rates to come back down, they have been disappointed to watch them continue to rise – along with home prices. An unexpected double edged sword. Although inventory is increasing, it’s still significantly below pre-COVID levels.

As an agent, I feel many people are tired of waiting. Life happens and my own personal opinion is that as soon as rates comes down as little as 1%, I feel more and more people will decide to finally make that move. Hopefully the mass of people jumping back into the market at the same time won’t repeat the wild days of 2021!

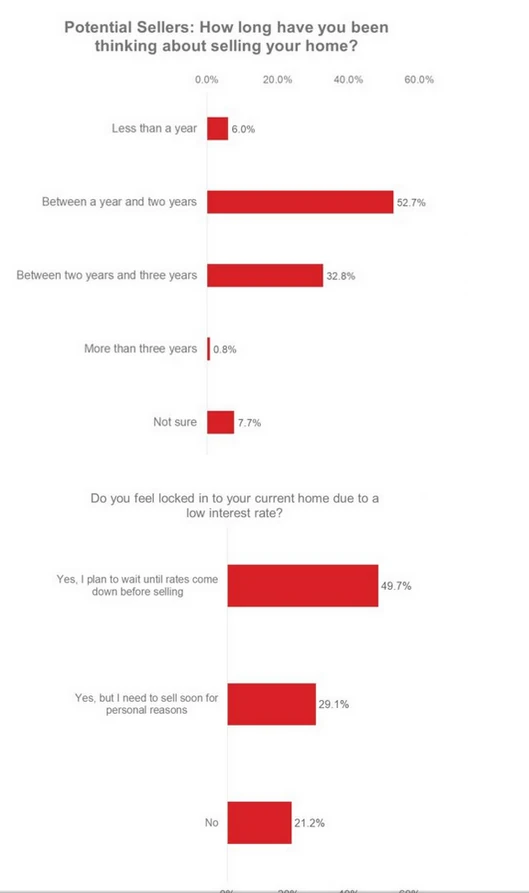

In a survey from Realtor.com, more than 80% of surveyed potential sellers have been considering a home sale for between 1 and 3 years, meanwhile recent seller sentiment suggests that 79% wished they had listed their home sooner and feel they could have taken advantage of a hotter housing market.

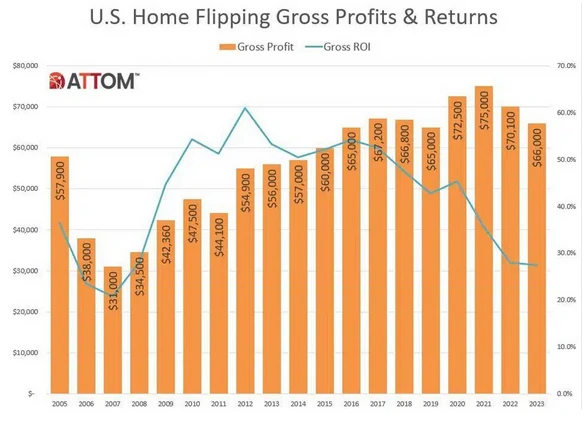

Home Flipping Plummets Across US in 2023 as Profits Slump Again

- Flipping Activity by Investors Declines at Fastest Pace in 15 Years

- Investment Returns on Flips Sink to Lowest Level Since 2007

- In 2023 308,922 single-family homes and condos in the United States were flipped. That was down 29.3 percent from 436,807 in 2022 – the largest annual drop since 2008.

- The sharp decline in the number of home flips likely reflected a combination of a tight supply of homes for sale as well as dwindling returns. Either way, it will take some significant reworking of the financials for home flipping fortunes to turn back around.

- Home flippers who sold homes in 2023 took an average of 169 days, or about 5 ½ months, to complete the flips. That was up from 165 days for homes flipped in 2022 and 158 days in 2021.

Thanks for taking the time to read my newsletter. Please don’t hesitate to contact me if I can assist you with a contractor referral, a query on what your neighbor’s house sold for, or of course, if you are thinking of buying or selling a home.

Jennifer Turberfield

Facebook

X

LinkedIn

Email

What’s Happening Franklin TN

April 17, 2024

Nashville TN Housing Market Trends April 2024

April 17, 2024

Mortgage Rates Trends, What’s Really Happening?

February 12, 2024